When Pivots Break

Retail "Liquidity", Equities, & Silver

Sometimes the structure of markets is the only thing that matters….

What’s the “structure” of markets that matter??? or mean?

It could be liquidity structures of real “liquidity” (not what I’m seeing on youtube with influencers and some bubble chart” …. liquidity is the plumbing of the Repo market, the ability of big size to get out of positions with no bid…. liquidity to find a market to sell into…. the ability to find a broker or better yet a counter party to trade with you and actually not be bankrupt to settle! Real Money Real Institutions Real Liquidity Problems.

Liquidity isn’t some level 2 quote data feed on a chart from some retail/prop firm….let’s be clear.

Any real trader that has institutional experience knows that every single platform allows you to “hide” size…. and there are “deep” pools off normal quote feeds and exchanges!

So an example when I had 200 million 10yr notes to buy I could put 10 million lot on the bid shown and hide 190 million on say BrokerTech (a real trading platform).

We have to define definitions and “structures”.

Structure can mean - Vol structure - where’s the gamma the dealer’s are positioned option wise …. It can mean who’s blowing up in an event like a major hedgefund liquidating everything and they can’t sell shit….it could mean technical market structure…

Or what I call TMS.

I don’t know every aspect of all the market participant’s structures or “liquidity” …no one does….

But I can give you the pattern of uptrends/downtrends correctly (not moving average crosses lol) and cycles of time ….. we have experience over 20years. This I call TMS (Technical Market Structure).

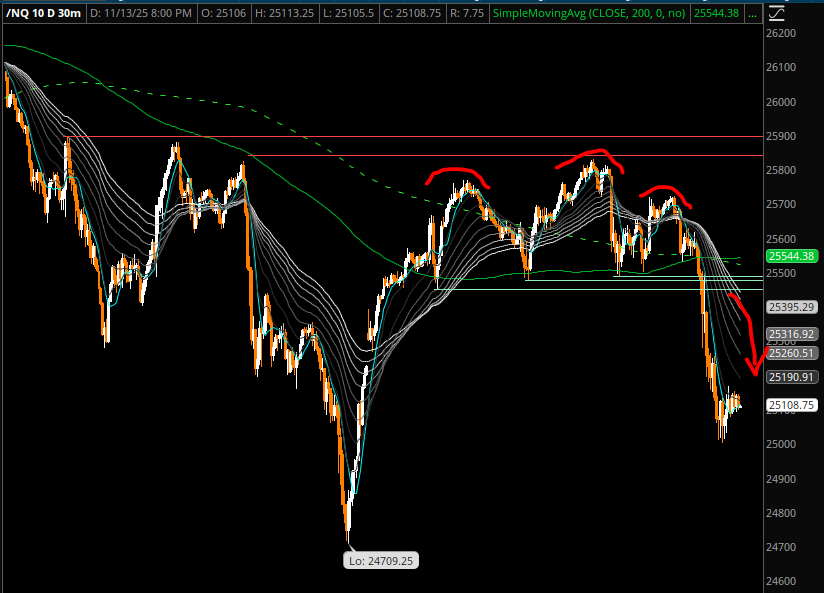

What I wrote this morning was a clear price technical structure setting up of a POTENTIAL trend change and a CYCLICAL structure (I didn’t go into the TIME aspect) this morning.

I said if THIS - THEN….that’s how to think about risk….not making 1 million dollar Bitcoin predictions to sell adds or get attention….

You manage risk by IF THIS HAPPENS THAN THIS IS PROBABLE….and next level - how ya gonna play it?

These patterns exist over and over on every time-frame and the real ALPHA is adding in the TIMING of cycles…. but it’s simple, not easy but simple if you can learn the pattern recognition, the probabilities, and how to play it.

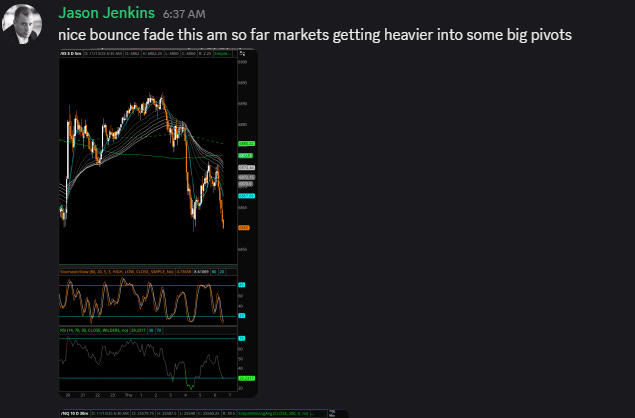

What I didn’t share this morning via Substack was the early setups that led to the sell off before US open….it was classic model…

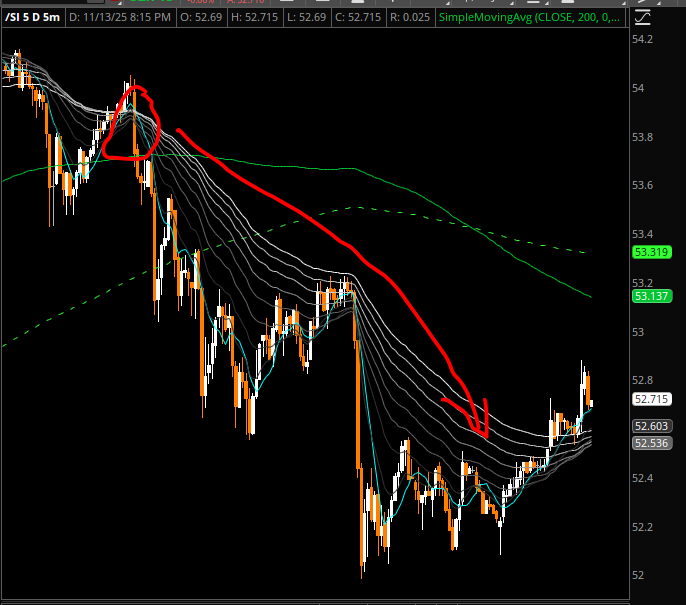

This was great near-term setup RMC in our model….on silver

How Silver finished….

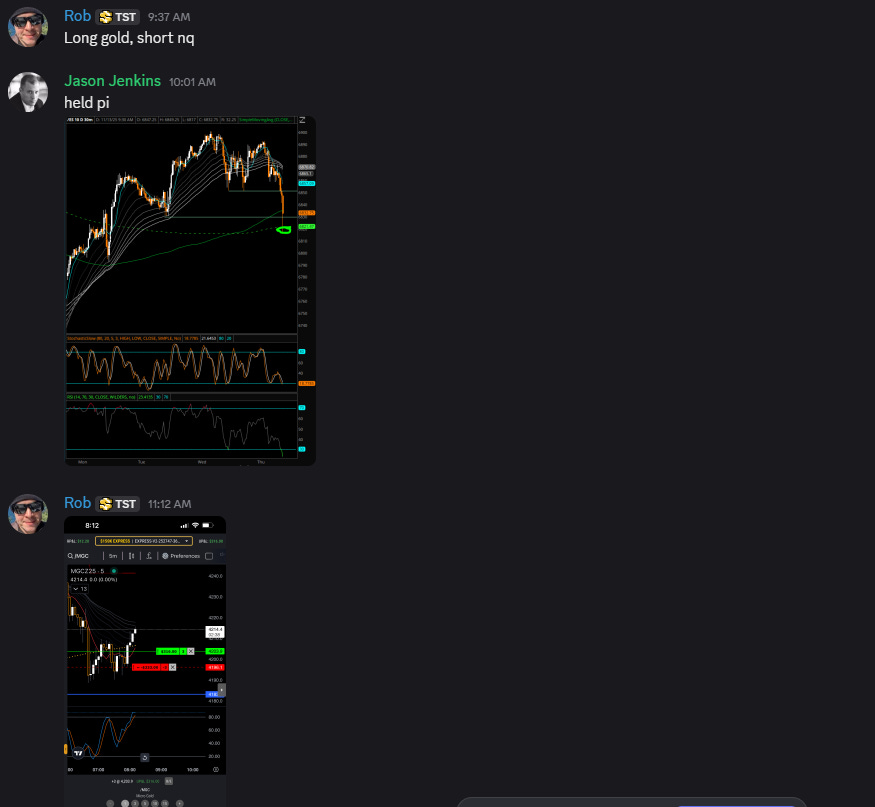

Even held Pi on the bounce off oversold lows…

So many moves in just one day…but hte point being is these are the outcomes of when PIVOTS break and the market structures change.

I didn’t even mention simple downtrend in London…. typical CYCYLEDGE model…

Was a nice day for the team - it’s always more fun to trade with a pick up in Vol…. but none the less, same day in day out model and process.

More to come on how to join our team/community/family. I’m putting it together behind the scenes, but for right now I’m just trying to add as much value as I can before these moves take shape, the best I can in this format.

Have a great night - the Jets suck! Go Broncs (8-2 get some! lol),

Jason Jenkins